2024 Irs Schedule D Instructions – Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

2024 Irs Schedule D Instructions

Source : www.incometaxgujarat.org

IRS Schedule D Walkthrough (Capital Gains and Losses) YouTube

Source : m.youtube.com

When Would I Have to Fill Out a Schedule D IRS Form?

Source : www.investopedia.com

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

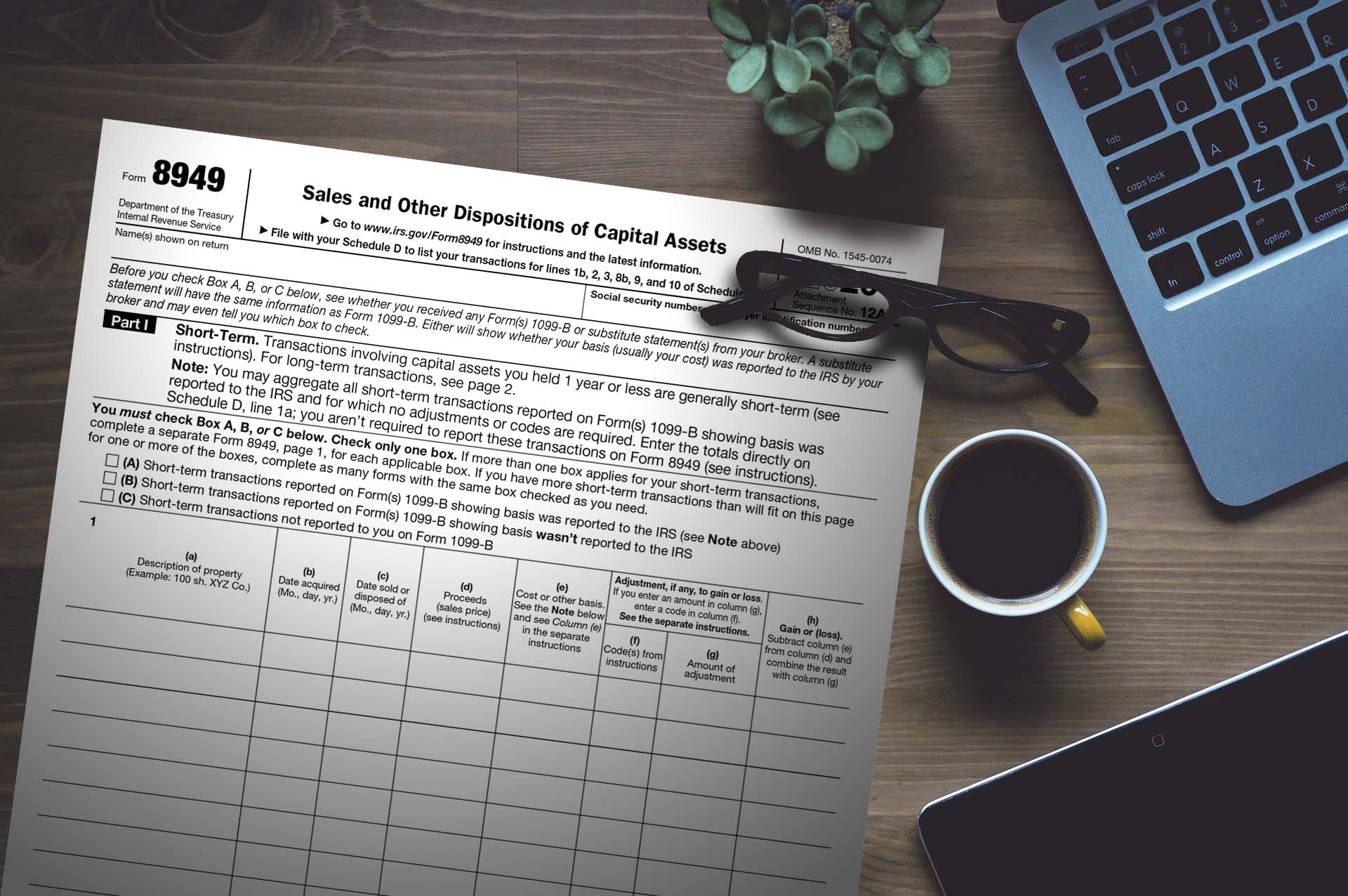

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

IRS launches paperless processing initiative for correspondence in

Source : newsismybusiness.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Articles of interest related to business accounting, INTERAC

Source : www.intersoftsystems.com

2024 Irs Schedule D Instructions Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D : The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . TheStreet’s J.D. Durkin brings the latest new thresholds for each of the seven tax brackets, as well as standard deductions. Starting in 2024, each bracket will increase by about 5.4 percent .

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)