Irs Form 1040 Schedule A 2024 – The IRS has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. Here’s what you need to know. . One place you can start your advance tax planning is with the standard deduction amounts for 2024. Fortunately, the IRS has already released the standard deduction amounts for the 2024 tax year. The .

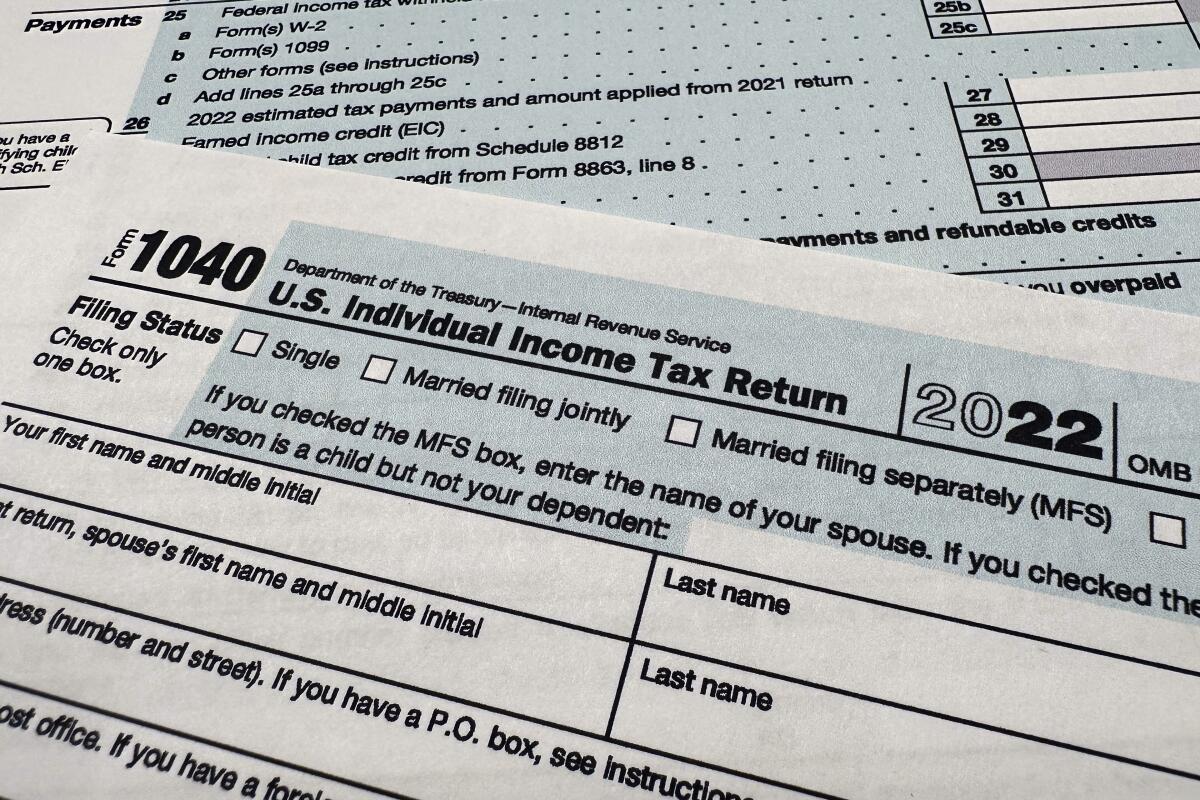

Irs Form 1040 Schedule A 2024

Source : www.incometaxgujarat.org

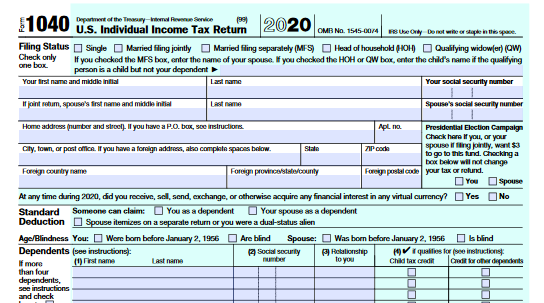

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What is IRS Form 1040 ES? (Guide to Estimated Income Tax)

Source : www.bench.co

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

Printable IRS Form 1040 for Tax Year 2020 CPA Practice Advisor

Source : www.cpapracticeadvisor.com

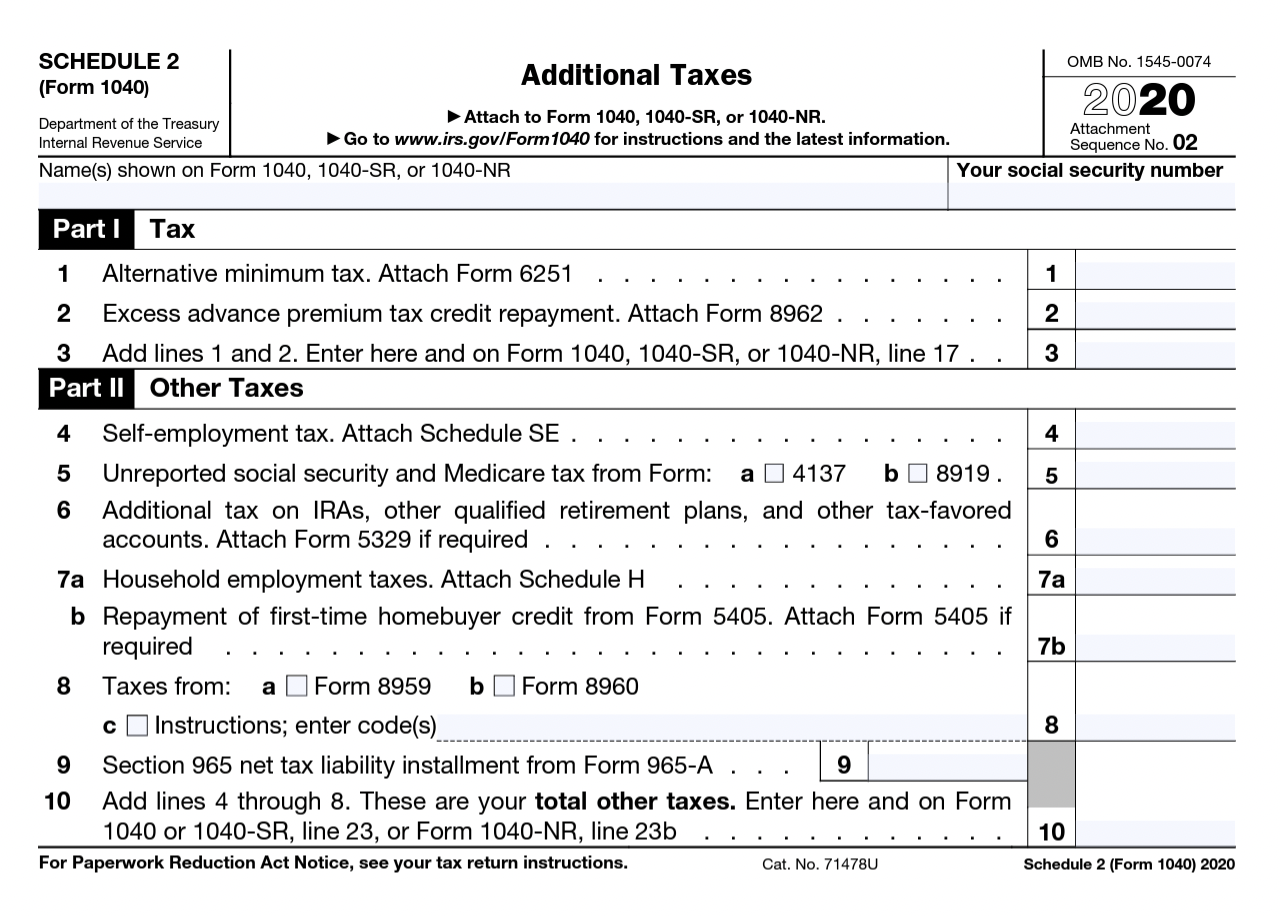

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

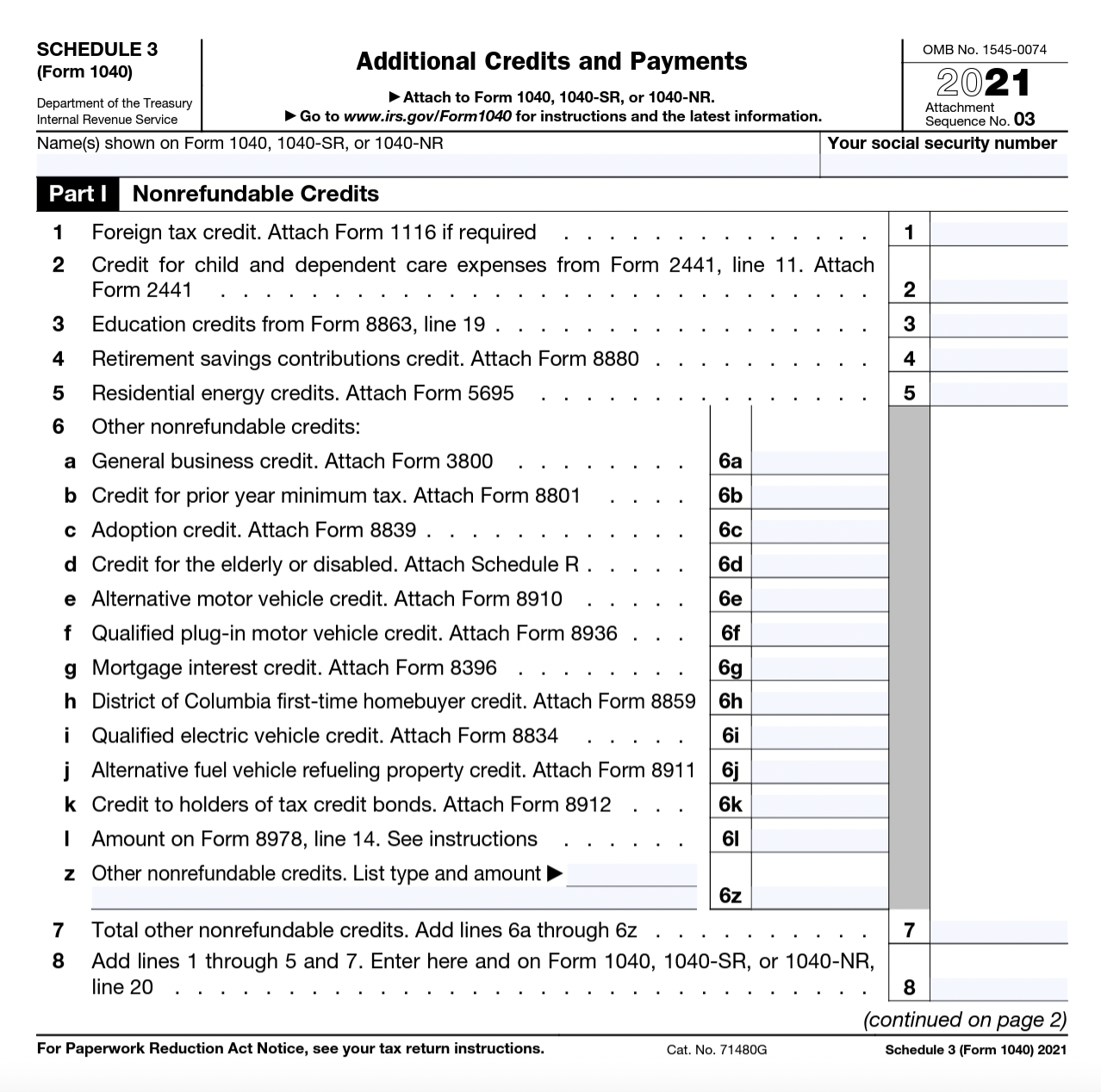

Irs Form 1040 Schedule A 2024 Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D : The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. . Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or .